Yr immediately after calendar year, Charity Automobiles prospects the country in giving no cost vehicles to battling households all throughout The usa. The connection in the American individuals with their vehicles has historically been a deep-rooted enjoy affair. The car is and proceeds to become a image of personal freedom and self-sufficiency.

You could donate your vehicle now to our auto donation application and help make it feasible for youngsters right here in Kansas Metropolis to love the globe around them.

” If you utilize any of right now’s greatest on the web tax application products and solutions, the program should really complete the demanded kinds in your case quickly When you respond to questions on your donation.

Non-money donations are the commonest triggers of IRS audits, so it is important to help keep thorough documentation of an auto donation. Exclusively, if your car is valued over $250, then you should get and keep a composed acknowledgment in the charity.

In return, supporters like the Moores, who donate a car or truck into the Pink Cross Auto Donation Plan, get a tax credit score and don’t have to trouble with trade-ins at applied a lot or run classified advertisements to locate a customer.

Our car or truck valuation authorities take care of Each and every auto independently to ensure the most important feasible donation towards the charity of your respective selecting. We don't take the initial present, we struggle in your donation to convey one of the most price.

It is an honor to donate my auto to St Jude, In particular given that I have experienced it quite a long time. We hope this auto goes to a superb trigger at St. Jude check here and aids out somewhat inside the care of somebody in will need."

Whilst there won't be any personal loan service fees connected to the Refund Progress mortgage, independent expenses may implement if you decide on to purchase TurboTax along with your federal refund. Shelling out with your federal refund will not be expected for your Refund more info Advance bank loan. More fees may possibly make an application for other services and products that you end up picking.

Excludes payment designs. This ensure is sweet for the life time within your individual or enterprise tax return, which Intuit defines as seven yrs from your day you submitted it with TurboTax. Additional conditions read more and limitations apply. read more See Terms of Provider for details.

Once you donate an automobile to Charity Autos, jogging or not, a hundred% of the donation goes to our charity and assists us give the present of transportation to your family members in require.

This could demonstrate, partially, why the Charity Automobiles donation software continues to be so enthusiastically embraced by most people and it has elicited lots of car or truck donations. Numerous donors report that they can empathize with the very poor who lack a car or truck inside our car or truck-dependent Modern society, possessing had the working experience themselves.

Many of the vehicles get more info donated to Automobiles for Residences to lift money that can help Construct properties are bought directly to licensed automobile recyclers. These recyclers are crucial environmental stewards and assistance to make certain conclude-of-life autos are processed securely and in eco-friendly strategies.

Be sure to see IRS Publication 4303, A Donor's Manual to Motor vehicle Donations, for info on how to ascertain the honest marketplace value of a donated car for which no 1098-C form is issued.

The charity donates or sells the vehicle to an individual in require for an exceedingly low (beneath market) price tag for the objective of helping them with transportation.

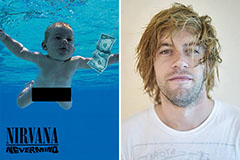

Spencer Elden Then & Now!

Spencer Elden Then & Now! Romeo Miller Then & Now!

Romeo Miller Then & Now! Bernadette Peters Then & Now!

Bernadette Peters Then & Now! Bill Murray Then & Now!

Bill Murray Then & Now! Erika Eleniak Then & Now!

Erika Eleniak Then & Now!